Manufactured Home Producer Price Index December 2025 - Wholesale Pricing Trends

Rob Ripperda

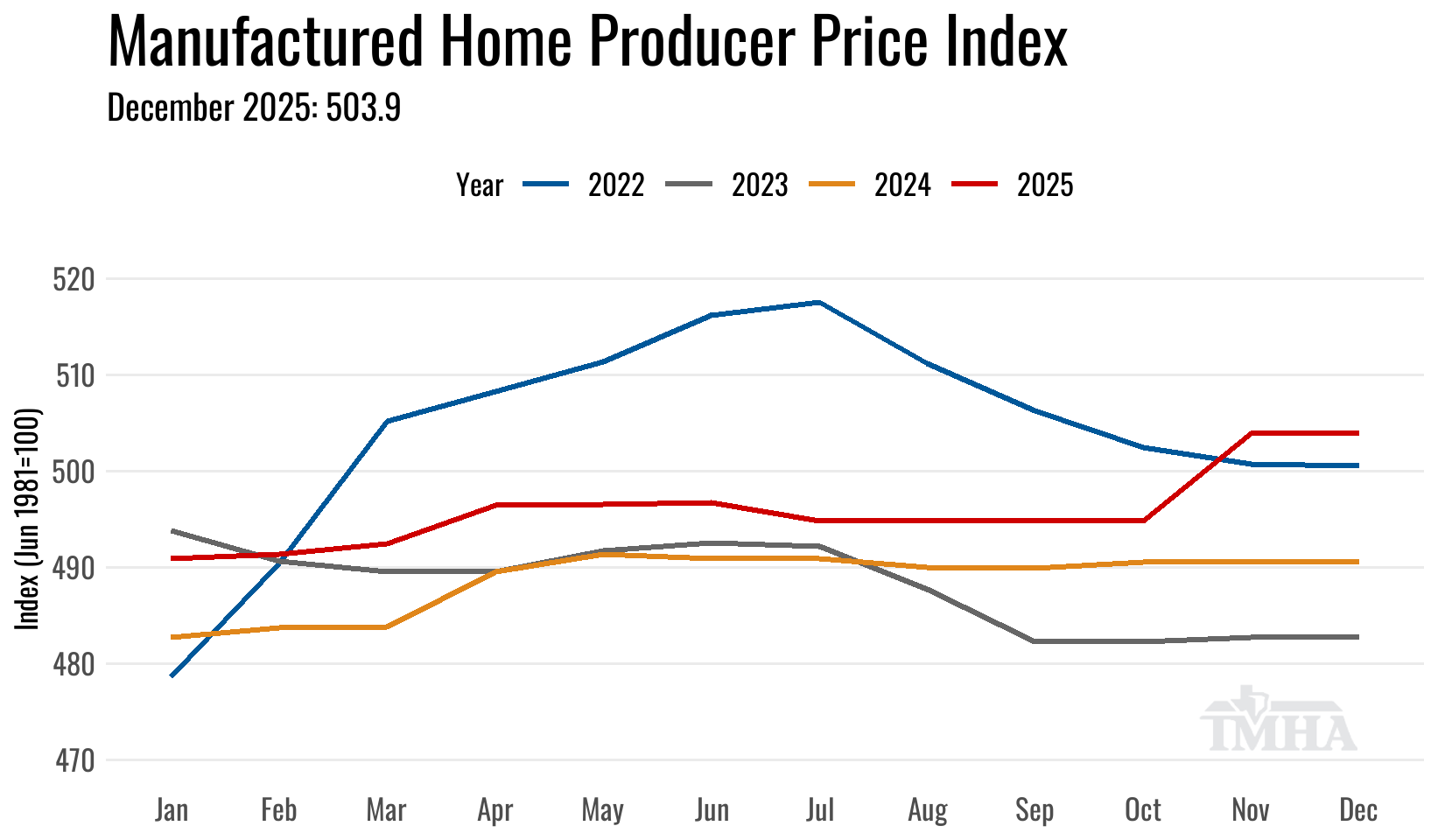

Manufactured Home (PPI)

The Producer Price Index (PPI) for manufactured housing in December showed no change from the previous month after the November reading was revised downward by 1.9%.

The downward revision and subsequent December reading puts wholesale prices below where they were at their peak in 2022, but we’ve finished the year at an all-time high for December.

The national PPI reading was in line with the Texas Manufactured Housing Survey (TMHS) which showed prices received moving sideways for the most part in December.

Wholesale prices nationally were up 2.7% above December of 2024.

This chart is built from the U.S. Bureau of Labor Statistics Producer Price Index by Industry: Manufactured home, mobile home, manufacturing, not seasonally adjusted (PCU321991321991)

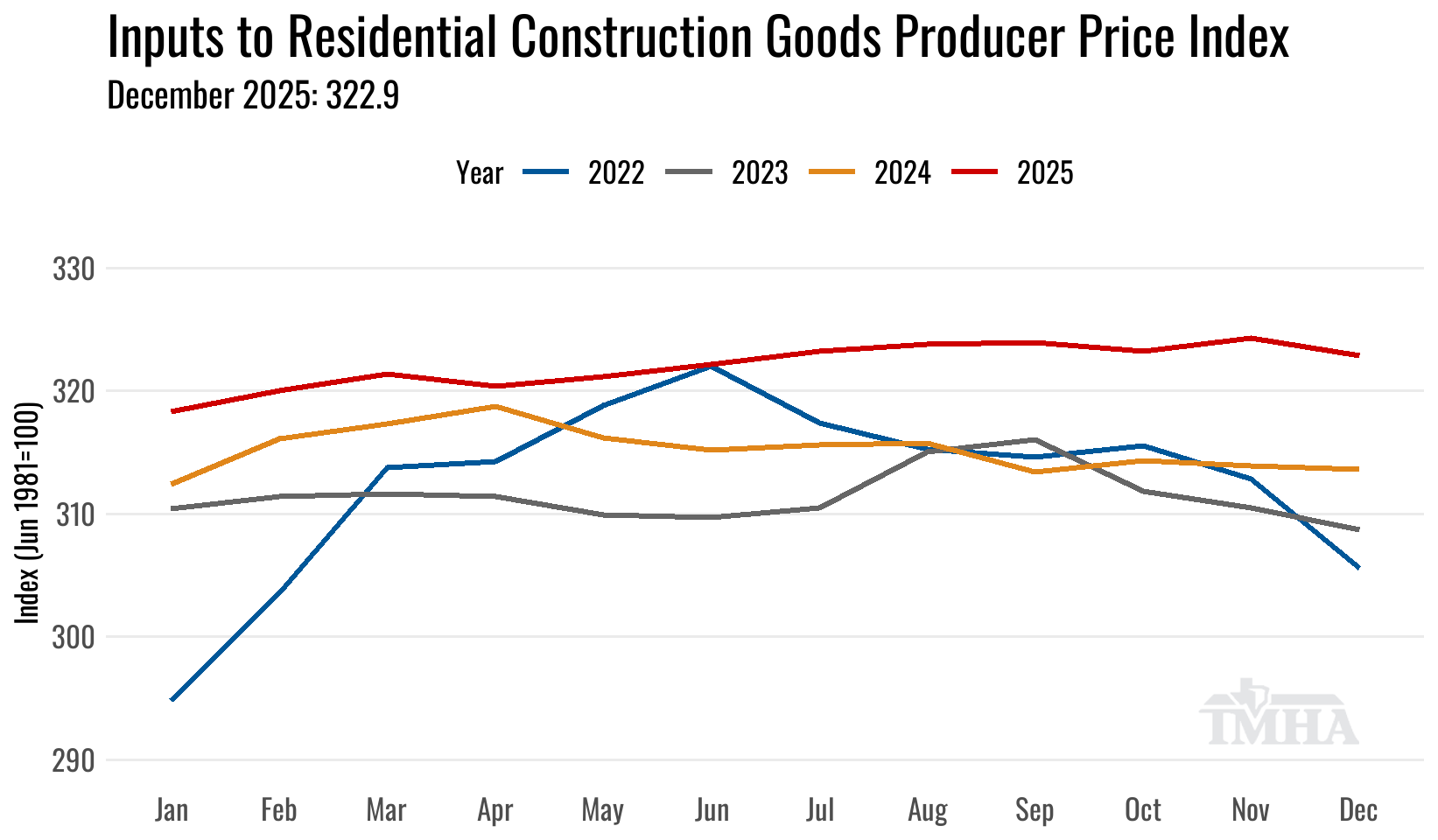

Inputs to Residential Construction Goods (PPI)

On the costs of materials to manufacturers the PPI for input goods to residential construction fell 0.4% in December from the all-time high set in November. The year-over-year increase for December was at 3% over 2024.

The Inputs to Residential Construction Goods is not a perfect proxy for manufactured home builders materials costs as it includes ready-mix concrete prices and does not include the steel used for chassis assembly, nor does it weight transportation costs as heavily as they would be in a manufactured home index. We plan on expanding this report to include looks at those markets individually in the coming months.

This chart is built from the U.S. Bureau of Labor Statistics Producer Price Index by Commodity: Inputs to residential construction, goods, not seasonally adjusted (WPUIP2311001)

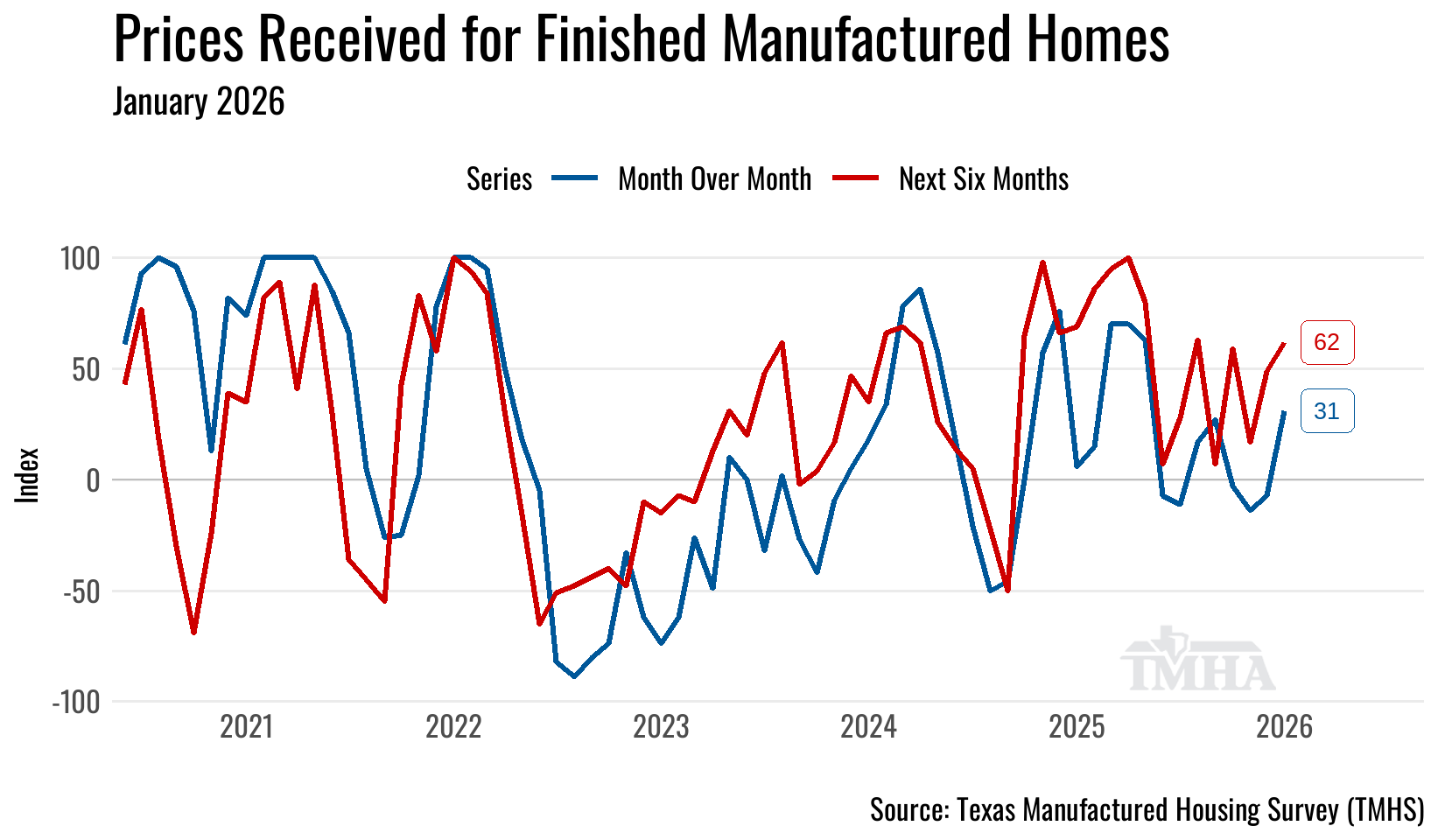

Prices Received for Finished Manufactured Homes (TMHS)

The regional Texas Manufactured Housing Survey (TMHS) results had prices received for finished homes near flat in December for manufacturers, but the weighted sample showed an increase in January.

We recently created a new report with the data and analysis on all of the TMHS indices for TMHA members.

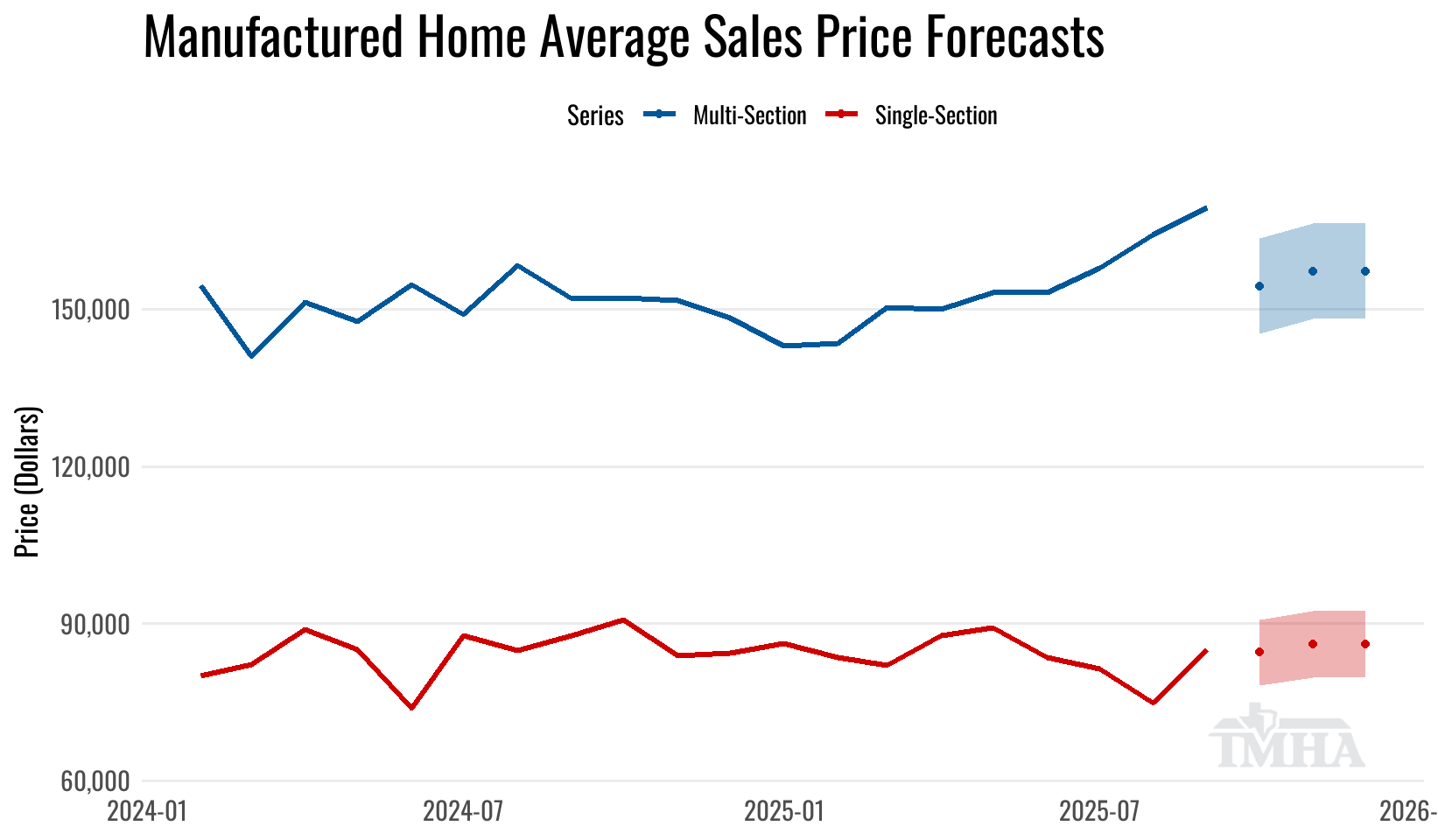

Average Retail Selling Prices with TMHA Forecasts (MHS)

Using the MH PPI in a regression model to predict average selling prices in the South Census region puts the average sales price in December at $157,200 (+/- $9,200) for multi-section homes and $86,100 (+/- $6,400) for single-section homes*.

*The PPI is not a perfect predictor for the Census’ Manufactured Housing Survey average price results, but it does account for over 90% of the variability when used in a regression model as the explanatory variable.